Understanding Forex Trading: A Comprehensive Guide

Forex trading, or foreign exchange trading, is the process of buying and selling currencies in the global market. It operates 24 hours a day, five days a week, allowing traders from various parts of the world to engage in currency trading seamlessly. The Forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. This high liquidity means that currency prices can change rapidly, creating both opportunities and risks for traders. If you are interested in delving into the world of Forex trading, you can start by exploring resources like what is forex trading https://acev.io/, which provide valuable insights and guidance.

What is Forex Trading?

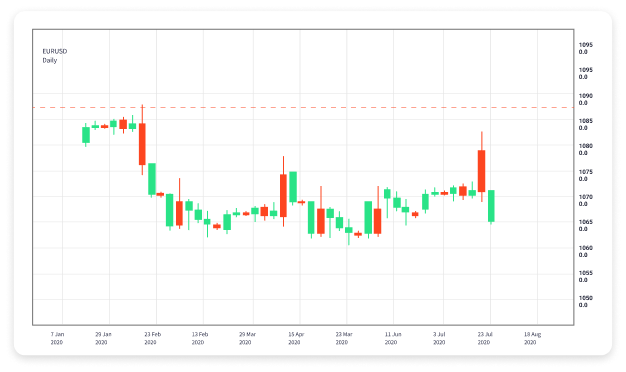

At its core, Forex trading involves the exchange of one currency for another. Traders speculate on the price movements between currency pairs. For example, trading the EUR/USD pair means you are buying euros while simultaneously selling US dollars. The goal is to buy low and sell high, profiting from the changes in exchange rates. Unlike stock trading, Forex does not involve a physical exchange of currency; instead, transactions are conducted electronically through trading platforms and brokers.

How Does the Forex Market Work?

The Forex market is decentralized and operates over-the-counter (OTC), meaning that there is no central exchange or physical location for transactions. Instead, currencies are traded through a network of banks, brokers, and financial institutions. This system allows for a more flexible and efficient trading environment. Forex trading is driven by a variety of factors, including economic data, geopolitical events, and market sentiment.

Key Participants in the Forex Market

Several players participate in the Forex market, including:

- Banks: Major banks conduct large volume trades for clients and themselves, influencing currency prices significantly.

- Brokers: Forex brokers provide trading platforms for retail traders to access the market.

- Corporations: Companies may engage in Forex trading to hedge against currency fluctuations when conducting international business.

- Traders: Individual traders, both professional and retail, speculate on price movements to make profits.

Understanding Currency Pairs

In Forex trading, currencies are quoted in pairs. For instance, in the pairing of EUR/USD, the euro is considered the base currency, while the US dollar is the quote currency. The value of this pair reflects how much of the quote currency is needed to purchase one unit of the base currency. Traders can go long (buying) or short (selling) based on their predictions of how a currency pair’s value will change.

Major Currency Pairs

The most commonly traded currency pairs include:

- EUR/USD: Euro and US Dollar

- USD/JPY: US Dollar and Japanese Yen

- GBP/USD: British Pound and US Dollar

- USD/CHF: US Dollar and Swiss Franc

Forex Trading Strategies

Successful Forex trading requires the use of effective strategies. Here are some popular strategies that traders employ:

1. Technical Analysis

This strategy relies on analyzing historical price charts and patterns to predict future market movements. Traders use various technical indicators such as moving averages, MACD, and RSI to identify entry and exit points.

2. Fundamental Analysis

Fundamental analysis involves examining economic news, data releases, and geopolitical events that can impact currency values. Traders use this information to gauge market sentiment and make informed trading decisions.

3. Scalping

Scalping is a short-term trading strategy where traders aim to make small profits from numerous trades throughout the day. This requires a strong understanding of market trends and quick decision-making.

4. Swing Trading

Swing trading involves holding positions for several days to capitalize on short- to medium-term trends. Traders analyze price swings and market trends to determine optimal entry and exit points.

Common Risks in Forex Trading

While Forex trading can be lucrative, it also involves significant risks. Some common risks include:

- Market Risk: The possibility of losing money due to adverse changes in currency prices.

- Leverage Risk: Using leverage can amplify profits but also increase potential losses.

- Counterparty Risk: The risk that the broker may default on a trade.

- Economic Risk: Changes in economic indicators can drastically impact currency value.

Getting Started with Forex Trading

If you’re interested in starting your Forex trading journey, here are some steps to consider:

1. Educate Yourself

Learn the basics of Forex trading, including terminology, market mechanics, and different trading strategies. There are many online courses, webinars, and resources available to help you.

2. Choose a Broker

Select a reputable Forex broker that aligns with your trading needs and offers a user-friendly trading platform. Ensure they are regulated to guarantee the safety of your funds.

3. Practice with a Demo Account

Many brokers offer demo accounts that allow you to practice trading with virtual money. This is an excellent way to familiarize yourself with the trading platform and test your strategies without financial risk.

4. Start Small

When you feel ready to start trading with real money, begin with a small investment. This will help you manage risk while gaining experience.

Conclusion

Forex trading can be an exciting and potentially profitable endeavor, but it requires a solid understanding of the market, a comprehensive trading strategy, and effective risk management. By educating yourself and practicing diligently, you can navigate the complexities of the Forex market and work towards becoming a successful trader. Always remember to stay informed about global economic events and market trends, as these can significantly impact your trading outcomes.